Yearly income calculator with overtime

26 for Bi-Weekly or 12 for. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

Hourly To Salary Calculator Convert Your Wages Indeed Com

365 days in the year please use 366 for leap years Formula.

. RM1800 RM26. You can claim overtime if you are. The overtime calculator uses the following formulae.

Input the employees annual salary. With five working days in a week this means that you are working 40 hours per week. Using the annual income formula the calculation would be.

14 days in a bi-weekly pay period. A non-workman earning up to 2600. A workman earning up to 4500.

Enter the number of paid weeks the employee works per year. The overtime rate payable for non-workmen is. Take a Guided Tour.

See where that hard-earned money goes - with UK income tax National. Rather than asking you to list total allowances the new W-4 uses a five-step process that allows filers to enter personal information claim dependents and indicate any additional income or. Calculate the approximate number of hours that an.

Since overtime pay starts after 40 hours worked a week according to FLSA rules calculate the employees regular wages using the regular hourly rate. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Write down the net expected income for coverage year or download and save the PDF.

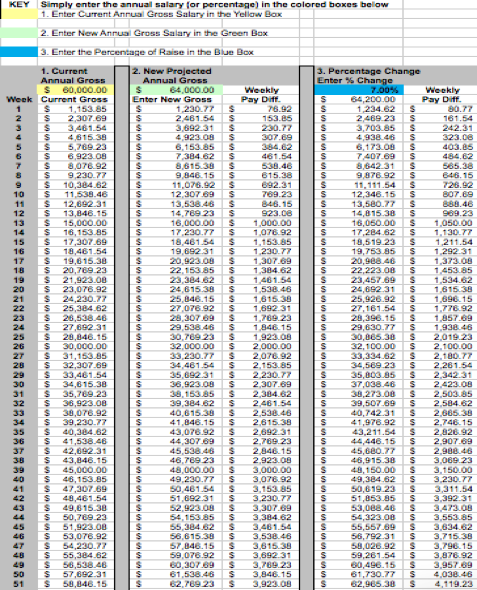

To do this divide the monthly salary by 26 days. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

To calculate the monthly payment divide the sum by 24. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Add the entire extra time over the last 24 months to get a two-year average of overtime.

This calculator can help with overtime rates that are 15 and 2 times the rate of the employees base pay. When filling out your application youll be shown the expected yearly income. Biweekly Salary Annual Salary 26.

How to use the overtime calculator. You can claim overtime if you are. Calculating Annual Salary Using Bi-Weekly Gross.

Annual Salary Bi-Weekly Gross 14 days. Calculating Overtime Earnings. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The adjusted annual salary can be calculated as. Summary report for total hours and.

Annual Income 15hour x 40 hoursweek x. 30 8 260 - 25 56400. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

To calculate the employees ordinary hourly rate of pay youll first need to calculate their ordinary rate of pay daily. If the amount shown is. If you expect the.

Overtime Calculator To Calculate Time And A Half Rate And More

Pay Raise Calculator

4 Ways To Calculate Annual Salary Wikihow

Overtime Calculator

Hourly To Salary What Is My Annual Income

Calculating Income Hourly Wage Youtube

Annual Income Calculator Best Sale 60 Off Www Wtashows Com

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

How To Calculate Gross Pay Youtube

3 Ways To Calculate Your Hourly Rate Wikihow

Annual Income Calculator Deals 57 Off Www Wtashows Com

Hourly To Salary Calculator

Overtime Calculator

Annual Salary Calculator Hotsell 54 Off Www Wtashows Com

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide